Middle Creek Mechanical & Welding

September 2, 2020

“This month, the headliner story covers an area outside the scope of cattle, cover crops and soil, to other endeavors at Ficke Cattle Company. I would like to take this opportunity to feature my son Austin Ficke’s venture: Middle Creek Mechanical & Welding.

This business is made up entirely of his vision and hard work along with the support of his wife, Alyssa. Both of them are a great help on the farm and are also pursuing their own livestock ventures as well as assisting with the Ficke Cattle Company – Graze Master Genetics ® herd.

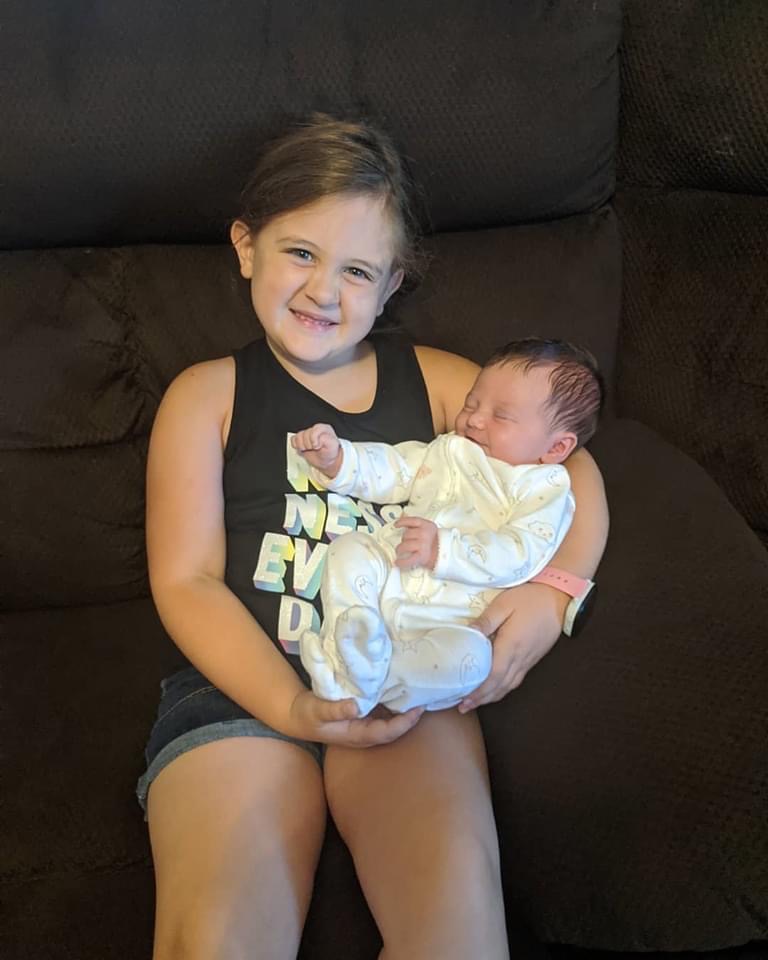

Brenda and I could not be happier that their growing family has found an interest in the farm and livestock operation and also decided to become agribusiness entrepreneurs right here at the headquarters.

We are also very proud of our now three, granddaughters – Attley, Hayden and brand new baby Olivia.

We hope everyone can use their gifts wherever they rest their heads. Keep dreaming, doing and supporting each other during these tough times.”

Sincerely, Del Ficke

“Hello friends and neighbors, Chase Eggerling and I will be doing pasture cleaning along with various other jobs this fall/winter. We have two track loaders and a growing list of attachments to handle the job quickly and efficiently. Feel free to give me a call/text anytime at (402)-499-3058 to get your name on the list. Thank you!” Austin Ficke

Contact: Austin Ficke

873 182nd Road

Pleasant Dale, Neb. 68423

402-499-3058

Follow Middle Creek Mechanical and Welding at: www.facebook.com/Middle-Creek-Mechanical-Welding-179983382688376

Some examples of Middle Creek Mechanical & Welding work:

Family Trees

By Brenda Ficke

There is a mighty cottonwood tree that stands over the hill we pass almost every time we check cows or move fence – whatever the task for the day is.

It sits on the edge of the creek and hold its ground there.

It is my favorite – a strong trunk holds the branches of the tree that sway in the wind bending and growing as it sees fit.

The roots are deep and sturdy – a home, I am sure, for many birds and insects.

Like the cottonwood over the hill, my family grows, and our roots are deep. We welcomed our third granddaughter, Olivia Rae, in late July. She is so precious and much loved already.

Mother Nature’s trees and human family trees – they certainly all tie together. This tree and our growing family made me think of another tree from my family’s past.

This picture is my Great Grandpa in Washington hauling a large tree on a wagon. This too is one of my favorites. This beauty was cut down with manpower – a testament of hard work and dedication.

Not long after this photo was taken, my Great Grandpa and his young family moved back to Nebraska where he farmed a bit and worked at a creamery until retirement. He kept a diary of daily activities, weather reports, whose letter they received, visitors, and a few memories sprinkled in.

He was a hardworking hero to his wife and children. I’m sure he never assumed those writings would be treasured by a great granddaughter who never knew him.

Take time my friends, count your blessings and remember your past. Talk to your parents and grandparents if you’re lucky enough to still have them, and learn the stories that helped make you who you are today.

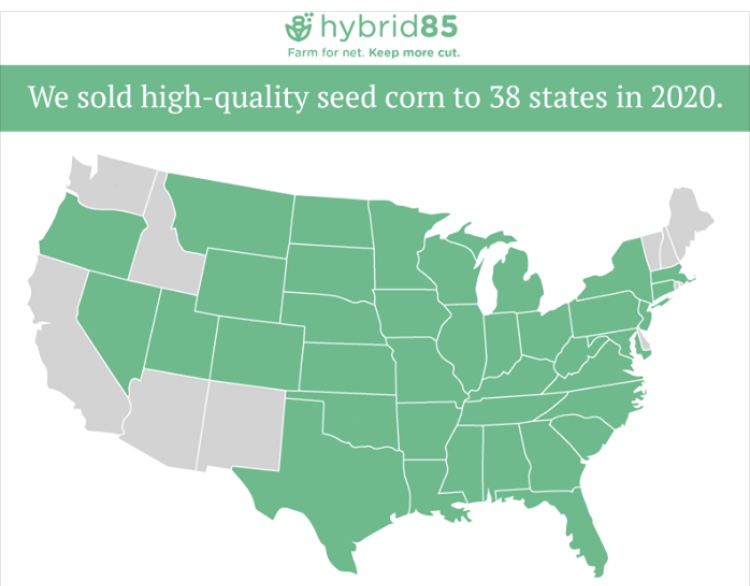

Honored to Serve Customers across the U.S.A

By Nate Belcher

Farmers in three quarters of the U.S. are growing our quality genetics this year! Maximize your farm’s net profit with $85/unit, non-GMO seed corn in 2021.

Give us a call, send us a message, or check out our website for more info. hybrid85.com

Nate Belcher looks forward to your call at:

402-580-0015

https://hybrid85.com/

greenacrescovercrops.com

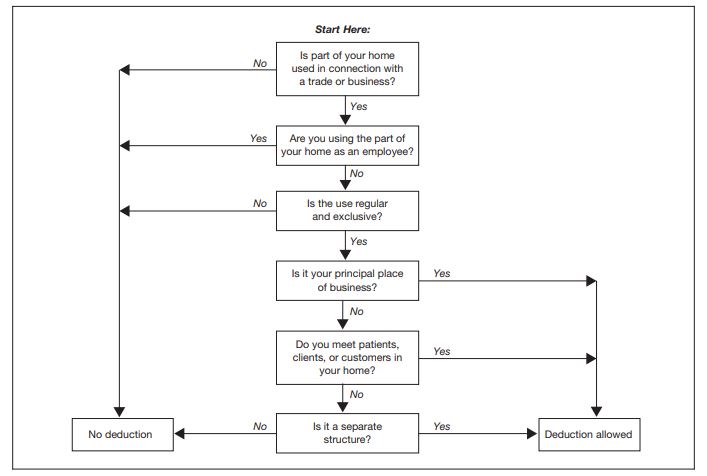

Claiming Home Office on Taxes

The

ongoing COVID-19 pandemic has kept countless people working from home

for months now. Many have been wondering whether they should consider

claiming the home office deduction on taxes next year so I thought I

would pass along some information to help determine whether this may be

an option for you.

According to this resource link: www.irs.gov/pub/irs-pdf/p587.pdf

from the IRS, your home must be your “principal place of business” for

your trade or business to qualify to deduct expenses for the business

use of your home. If you have another “fixed location where you conduct

substantial administrative or management activities,” then you do not

qualify for the home office deduction.

In other words, if you commuted to an office before March 2020, it’s

unlikely you qualify for the home office deduction. If you principally

worked from home before the pandemic, you may qualify for the home

office deduction.

Also, this link: www.irs.gov/businesses/small-businesses-self-employed/simplified-option-for-home-office-deduction

is an additional resource from the IRS to help clarify the home office

deduction. I recommend consulting your tax professional if you are

thinking of taking the home office deduction or want an opinion on your

specific circumstances.

Contact: Kirk Peterson – Peterson Asset Protection Group at:

kirkpeterson@woodburyfinancial.net

(402) 519-0330

www.petersonassetprotectiongroup.com

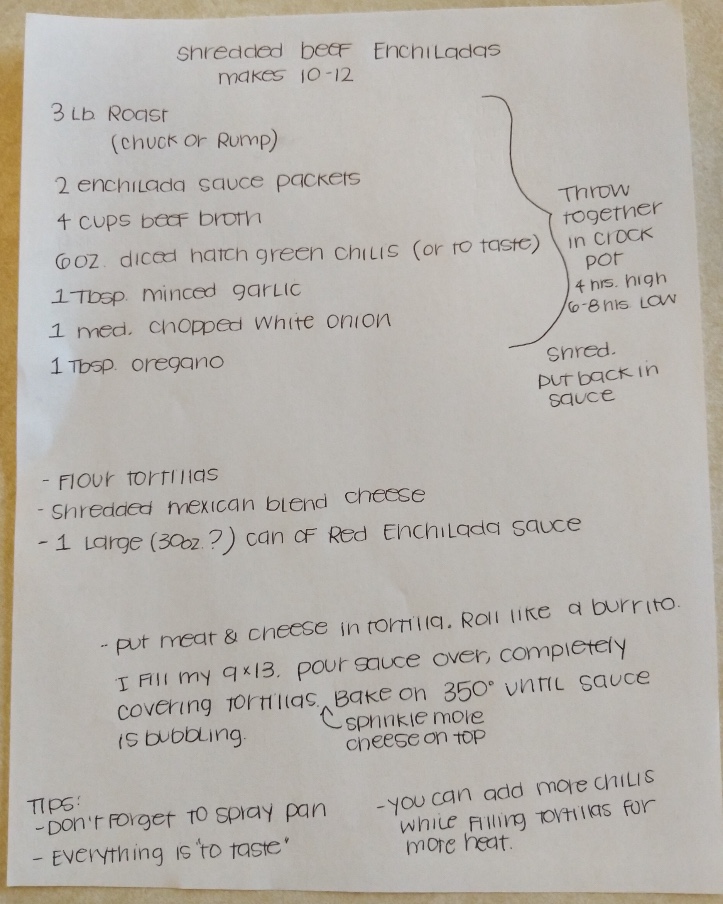

Graze Master Enchiladas

By Alyssa Ficke

Alyssa Ficke whipped up this recipe quick and wrote it down the old fashioned way. She’s sharing this homegrown recipe with all of you. It’s a great busy school night dish for the whole family! With such neat writing, many generations will be able to read her recipes for years to come!

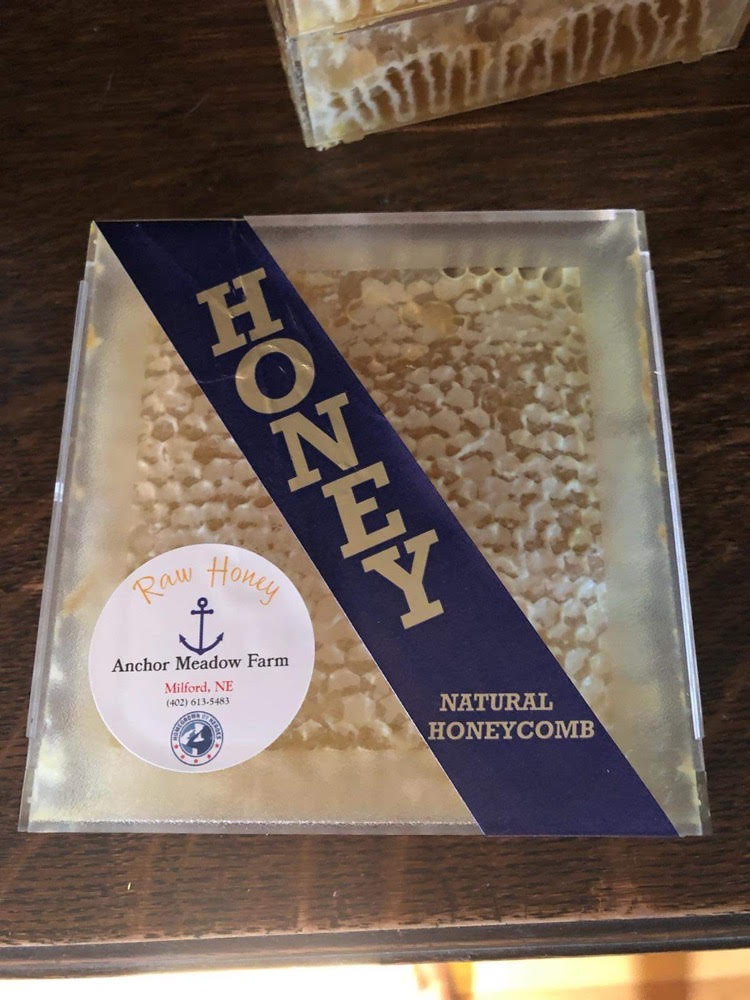

A Honey of a Deal

By Emely Hendl

Honeycomb was much simpler to make this year with the help of a box that has divided squares. This allows the bees to make individual boxes of comb. Anchor Meadow Farm Natural Honeycomb is a nostalgic treat for many as they love to chew on the comb while tasting the sweet wildflower honey.

Call Emely Hendl at 402-613-5483 to place an order. The holidays will soon be here, and honey is always a sweet gift!

Follow Anchor Meadow Farm at: www.facebook.com/Anchor-Meadow-Farm-245014352709769/

From our family to yours . . .

Thank you for reading. See you in September and have a safe start to harvest.